Property Information

Geographic Information System (GIS)

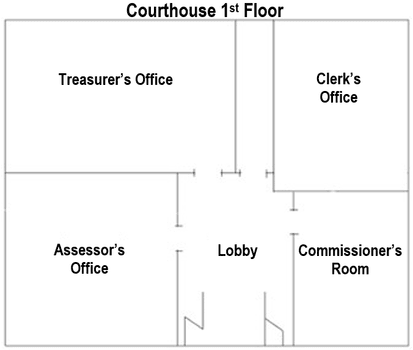

The Dawes County Assessor’s GIS system makes property information easily available. Using this system you can search for a particular property and retrieve all publicly available information about it.

Property Assessment Topics

The following links provide information on various Property Assessment Topics:

Forms

These are editable pdf forms that can be filled out, printed, and turned in. For a full list of available forms please visit the Nebraska Department of Revenue Property Assessment Division.

-

(Form 422 allows real property valuation to be stated for land, buildings, and total)

-

(Form 422A allows real property valuation to be stated in total)

-

(agricultural society, education, religious, charitable, cemetery)

-

(agricultural society, education, religious, charitable)